At this rate, the throne might as well be replaced by a diamanté wheelchair

Why do most parents who leave an inheritance leave it to their children? Why, when most people are well past middle age when their parents die, is this still considered the norm? Now that we live about a generation longer than people did when these rules evolved — in harsher times, many centuries ago — shouldn’t it be grandchildren who inherit?

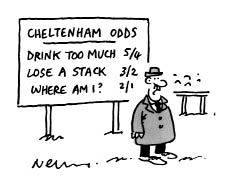

The question occurred to me while I was reflecting on the misfortune of Prince Charles, who is my age. It has always been said that the Queen regards her job as being for life, and there’s no sign of her flagging or of her capacities starting to dim. If her mother’s life is anything to go by, she’ll be fine for at least another decade. By which time the Prince of Wales will be 70.

Poor man. It is one thing to carry on past 70 as a reigning monarch, as the Queen does, when you’ve already been on the throne for more than half a century. She knows the ropes by now, and there cannot be too much more to learn, or nasty surprises her responsibilities are likely to throw at her. Quite another thing, however, to have to start a job for the first time — any job — when already in your seventies; and particularly this one. And if Charles carries on reigning for 20 years, William will be middle-aged when he ascends the throne. It’s to be hoped he doesn’t marry and father a male heir too soon, or his son will share that fate.

The happy and glamorous accident of Britain’s having a young queen in the middle of the last century, and of our getting to know her (and she us) over many decades, is entirely due to a sadder accident: the very premature death of her father. But such accidents excepted, and medical science progressing as it does, we now look destined as a kingdom to acquire our monarchs at an age when their eyesight’s going, their teeth are gone, their looks went decades ago, and their memories are not what they were. At this rate the throne might as well be replaced by a diamanté wheelchair.

And the problem is reproduced among the monarch’s humbler subjects, all the way down the social scale. There will no longer be any dashing and handsome young dukes, except as a result of the untimely death of a parent: dukes (who do not even have the option of abdicating) will inherit in their sixties. Dustmen will long have hung up their boots and retired by the time their parents pass on. The middle classes are likely to be learning the contents of their parents’ wills at a stage in their lives when they’re winding down, contemplating downsizing the house, and studying brochures for Saga holiday cruises.

A modest inheritance is, of course, pleasant to contemplate at almost any stage in one’s life, however late (though as one of a large family my expectations always had to be divided by six), but the point when I really needed a few thousand pounds was in my late twenties, a few years into my first job, when I was looking to set up home. This was around the time my grandparents were heading for the exit, and I did not for a moment begrudge their eldest daughter, an already elderly aunt, getting the lot; just as I hope my young nephews and nieces did not begrudge its being passed on a generation later to their own ageing uncles and aunts; but, really, is this an efficient or sensible way to proceed?

As a culture we could change this, but there’s a very good reason we haven’t. The change would necessitate the one-off skipping of a generation. Thereafter, nobody would be any the worse off — heirs would simply inherit from the second generation back, rather than the first — but if we made the change tomorrow one whole generation would miss out, and it happens to be the generation that is politically and economically in charge: that part of the population aged between about 40 and 65. This cohort is well-placed to block such a change. Their children, meanwhile — who would be the beneficiaries — will be young and powerless (many not even of voting age); and of course their parents can easily rationalise their selfish opposition to the move by reflecting that the children will get it in the end. They will — but, again, a generation behind the optimal time.

Society doesn’t do logical change, so perhaps it’s pointless to speculate on how we might effect this reform if as a culture we decided to. But here’s how. Many of the laws relating to inheritance in the monarchy and aristocracy could be changed at the stroke of a legislative pen. A whole generation poised to inherit would have the inheritance snatched away, but could console themselves that it would go straight to their children.

For the rest of us commoners, the present rules governing what we call death duties (which offer exemption only to surviving spouses and civil partners) could be relaxed to include descendents: but not the next generation (their children). Instead, the generation after that (their grandchildren, or in the absence of grandchildren, great-nephews and great-nieces) would be eligible.

The reform’s worth thinking about. The opportunity to make these simple changes in tax law will be removed if the next Tory government does, as it promises, abolish most death duties anyway; but in our economy’s current straitened circumstances, we’d best believe that promise when we see it delivered.

Beyond this, change would be more complicated to promote, but one suggestion might be to address a widely felt sense of grievance that if a pensioner is forced to move into a nursing home, the value of their house will count against their qualifying for means-tested state benefits to pay for the home. We might go halfway to meeting this grievance by allowing pensioners to give their houses not to their children, but their grandchildren — without the current risk of death duties becoming due unless the donor survives for at least seven years. Not everybody entering a nursing home can feel confident of that.

Fiddling stuff, you may think; but it could be part of a collection of small changes all designed to foster a change in an outdated cultural assumption: that parents are likely to die before their children reach middle age. They no longer are, and our approach to inheritance should reflect that change.

Comments