James Forsyth reviews the week in politics

Alistair Darling will stand at the Dispatch box on Wednesday and say that there is a plan to halve the Budget deficit in the next four years. His quiet delivery and demeanour of an Edinburgh lawyer will make this sound like a reassuring return to fiscal sanity. It is anything but. In reality, it means that the government intends to borrow another £500 billion — more than what the government spent in the whole of 2005 — over the next four years. Halving the deficit doesn’t mean making government expenditure match government revenue. It just means that the government will borrow less each year than it does now.

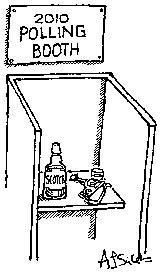

Labour are capitalising on the confusion between the word ‘deficit’ (i.e., government overspend) and ‘debt’ (i.e., the national overdraft). The two are completely different but the media, and so the public, regularly get confused between them. For instance, just this Tuesday, the seven o’clock news on the Today programme announced that the government had a plan to halve the debt in the next four years.

Darling’s proposal is like an obese man saying he is going to deal with his weight problem by putting on weight less quickly than he did before. The Chancellor is betting, with understandable confidence, that the media will never put it in these terms and stick to those d-words that sound so alike.

If Gordon Brown has an economic genius, it is his ability to use figures, metrics and language to mislead. For example, he has used the phrase ‘pay down the deficit’. The language is deliberately deceptive. One cannot ‘pay down’ an overspend. But Mr Brown seeks to invoke the idea of paying down debt — something you can only do if you are running a Budget surplus, which Labour has no plans to do. The Brown-Darling proposal is to borrow so much that the cost of servicing the extra debt it intends to run up if re-elected will be £20 billion a year by the end of the next parliament, four times the amount earmarked for the scandalously underfunded campaign in Afghanistan this year.

Brown’s linguistic tricks, though, are less effective when it comes to dealing with the markets. The amount of interest Britain must pay on government debt — the so-called gilt yields — is greater even than Italy’s. This means that a country that has had 61 governments since 1945 is now considered more creditworthy than this country.

Next week’s Budget will, it is to be hoped, be the last delivered by a Brown government, and the Treasury is telling the rest of Whitehall that it will be a ‘no news Budget’. If so, it will likely be spun as a triumph for Alistair Darling. But that is too easy on Darling, who has managed to portray himself as fighting a one-man operation against the ‘forces of hell’ (what better title for his autobiography?). One’s sympathies are naturally with someone who has Ed Balls, Damian McBride and Charlie Whelan as enemies. There is something admirable in his acts of defiance. When No. 10 asked what interviews Darling will do before this year’s Budget, the Treasury simply replied that ‘he’ll be out and about’.

But, as Chancellor, Darling is responsible for the last three budgets. It was Darling who acquiesced to almost every popular area of public spending being ring-fenced, something that will make the cuts that much deeper elsewhere. It was Darling who announced an economically damaging new 50p rate of tax — an act of fiscal sabotage designed purely to cause political problems for the Conservatives. And it is Darling who has agreed to put the comprehensive spending review off until after the election, hiding the painful truth of the cuts to come from the voters. It goes without saying that the growth forecasts that Darling will read out on budget day will be so optimistic as to be meaningless — as the European Commission warned this week (but in far more polite language).

Another man whose fingerprints will be on the budget is Lord Mandelson. He was infuriated by how the Pre-Budget Report appeared to mark a return to the crude ‘investment versus cuts’ dividing line advocated by Ed Balls. His friends say that he had argued that Labour should show it has adapted to the harsher economic circumstances, as households have had to do. The resulting tensions between Mandelson and Brown nearly led to their rapprochement collapsing in December. But his lordship is now confident that Labour has three prongs to its economic trident: higher taxes on those with the broadest shoulders (i.e., tax-the-rich), spending reductions and investment in growth.

‘Investment in growth’ — the mantra of the Japanese government during its ‘lost decade’ — is a euphemism for the money that Mandelson wants to spend on his department’s technology and new industrial agenda. He believes that New Labour kept ministers and markets too far apart, and that government can match-make between new technologies and the market. How this differs from the old, and failed, Franco-German government strategy of ‘picking winners’ is not entirely clear.

Labour will have a little bit of money to work with in this Budget. The tax on bankers’ bonuses has gained considerably more revenue than was expected. There will be talk of ‘efficiency savings’, the traditional government way of finding some extra cash. There is also talk of a levy on the banks of some kind. The responsible course of action would be to put all of this money into deficit reduction. But there is an election to fight, so a chunk of the money, perhaps a very large chunk, will go on ‘investment in growth’. One can almost hear Brown booming on the campaign trail, ‘We will invest in growth. The Tories will not.’

When Tony Blair unexpectedly declared in 2000 that he was going significantly to increase health spending, Brown roared at him, ‘You’ve stolen my f—–ing Budget!’ But Brown has done far worse: he has stolen a whole decade of budgets from his successors. For at least the next ten years, Chancellors will be trying to repair the damage that Brown has done to the public finances.

Comments