The Guardian have an odd story today. “Business chiefs who backed cuts now doubt UK growth,” runs the

headline — suggesting that these sinners are now being confronted with the error of their own ideology. Who are the business chiefs? We have Archie Norman, the retired head of Asda, now

part-time chairman of ITV. He “said the government’s growth targets were too optimistic”. Set aside the fact that the government doesn’t make growth targets now, and has

subcontracted that the Office for Budget Responsibility. Where is the connection between growth downgrades and cuts? In the imagination of The Guardian, I suspect.

The Guardian have an odd story today. “Business chiefs who backed cuts now doubt UK growth,” runs the

headline — suggesting that these sinners are now being confronted with the error of their own ideology. Who are the business chiefs? We have Archie Norman, the retired head of Asda, now

part-time chairman of ITV. He “said the government’s growth targets were too optimistic”. Set aside the fact that the government doesn’t make growth targets now, and has

subcontracted that the Office for Budget Responsibility. Where is the connection between growth downgrades and cuts? In the imagination of The Guardian, I suspect.

Next Andy Bond, another former head of Asda, is quoted as saying, “I don’t think the private sector is going to be able to pick up the slack in this climate.” Just what he meant is

unclear, as The Guardian conveniently doesn’t mention the context or timeframe. But the next paragraph is triumphant:

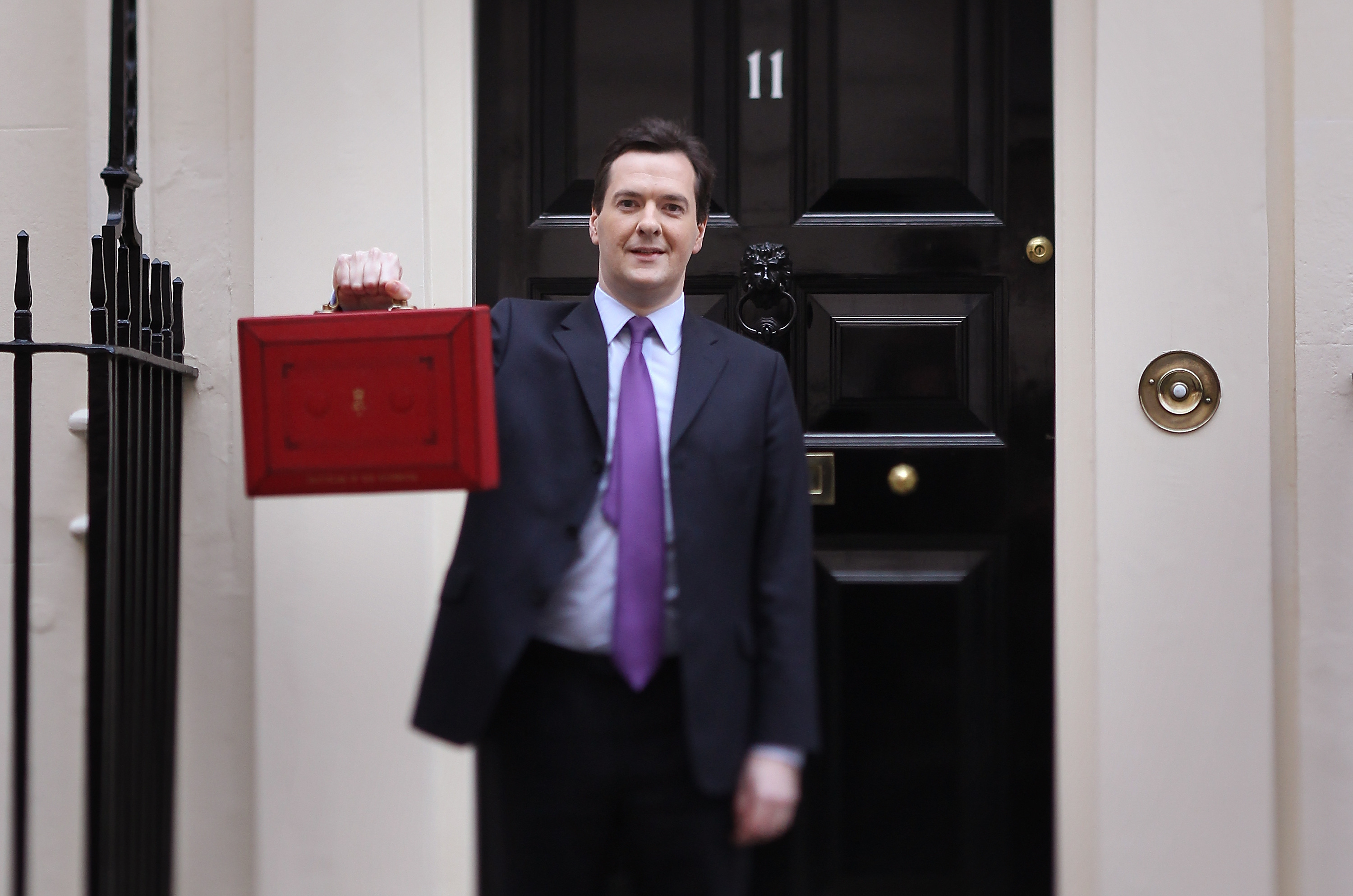

In a normal, balanced piece the journalists would then hunt down the latest independent figures on private sector growth — to put this into context. Below are the latest figures from the OBR from the last Budget:“He [Bond] was one of 35 bosses who signed a letter to the Daily Telegraph six months ago supporting George Osborne’s plan to slash the deficit and arguing that businesses ‘should be more than capable of generating additional jobs to replace those lost in the public sector.’”

So the private sector is indeed taking up the slack. Not that you’d know this from what George Osborne says, because neither he nor anyone else in the government makes this very important point. As we know, government cannot “create” jobs. The best it can do is move jobs, from the private sector to the state sector. Every penny paid to a bureaucrat has to be earned by someone else — and withdrawing money from the real economy can only stunt the recovery in the real economy.

Osborne is, if anything, retreating on this agenda. The OBR actually forecasts that there will be 20,000 fewer public service job losses than it envisaged last November. In the new financial year, 2011-12, total state spending will fall by just 0.6 per cent. Osborne risks taking all of the political pain, and making none of the economic progress. Being Chancellor is about more than producing a budget once a year. It’s about making the argument for the government’s economic mission, explaining the concept of private sector job creation, and doing more than just saying “if I don’t cut, the bond markets will eat me alive”. As Chancellor, he needs to win the argument — and that means engaging with it more closely.

As far as I can make out, Bond’s point is that inflation — not cuts — is seriously threatening the recovery. That rising prices, and falling real wages, will hit consumer spending and also retailers’ margins. I agree, and fear that Osborne has been too slow to realise that a) Mervyn King has failed to control inflation, b) King’s constant plea that this just a blip is demonstrable nonsense, c) his inflation targeting record is, literally, the worst of any central bank in the world, and d) That King and the MPC are not going to solve inflation, contrary to their claims. Posen, bless him, is talking about a return to 1.5 per cent CPI. It’s a delusion. Their analytical framework has proven inadequate, as their constant failure over the last year shows. The Chancellor will have to step in: ultimately it’s his responsibility. It’s his recovery plan being ruined.

Inflation, not cuts, is the villain. Osborne had better start to make this case quickly — because the left will very quickly draw their own misleadingly simplistic conclusions.

Comments