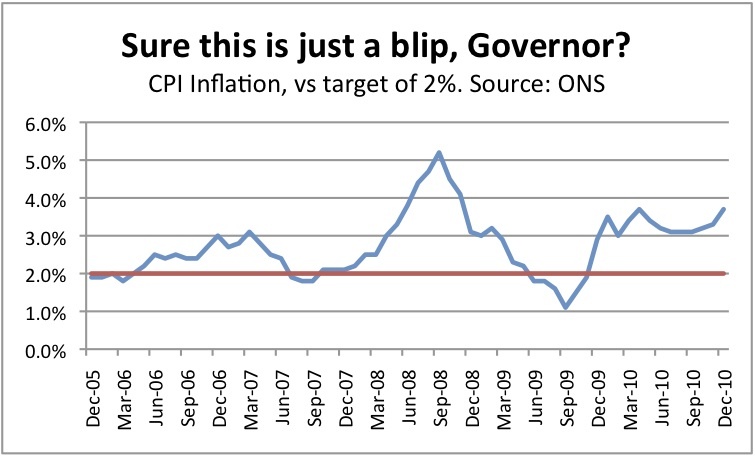

How big does inflation have to get before our politicians admit that it’s a problem? Once again, it has “surprised” on the upside – the CPI index stood at 3.7 percent for December, against a supposed target of 2.0 percent. And the RPI index, which the nation called “inflation” until Gordon Brown asked the media to use CPI instead, is running at 4.8 percent – almost twice its former target of 2.5 percent.

That is the painfully high figure to which George Osborne has just added a juicy VAT increase, which is bound to take CPI above 4 percent. Inflation has been above target for three of the last four

years – and still Mervyn King says it’s a blip. This is how he justifies the UK’s low interest rates (0.5 percent) – an absurd rate, when you consider that the economy is forecast to

return to normal growth of 2.0 percent this year. It’s almost as if they are turning a blind eye to inflation, given its myriad political uses.

Inflation, not jobs, will be the killer of 2011 – and there is a growing suspicion in the City that Britain has adopted an unofficial policy of trying to inflate our way out of debt. This is a

well-used but morally deplorable formula, which in effect transfers wealth from savers to borrowers. These low rates help the likes of me, as I have a huge mortgage on a rock-bottom variable rate.

But inflation of 4.8 percent eats into the nest-eggs of the prudent and hits pensioners hard. Yes, inflation finances the misbehaviour of governments – by making the cuts process politically

easier. But it’s the small people, the savers, the people who queued outside Northern Rock, who are paying the price.

I remember when Northern Rock collapsed, and people queued outside to remove their savings. Westminster looked on amazed. Who are these people? Savers? Not a species very well-represented amongst

the highly-leveraged class of commentators and policymakers. That’s why the pain and injustice of inflation is often only understood in Westminster when it’s too late.

But surely, it is argued, inflation is due to global forces? If that was the case, why are prices falling in Ireland? Why is the Eurozone today reporting fairly steady average CPI inflation of 2.3 percent? Commodity prices are creeping up, but only in Britain

and Greece has this translated into inflation at such punishingly high levels – as the below graph shows.

On Sunday, on the BBC1 Politics Show, I asked Danny Alexander if he accepted that inflation is now a problem for the British public. He dodged my trap, saying that it’s not his responsibility. “But you must have opinions” I ventured – he didn’t take the bait. Slip him a truth drug, and I suspect he knows that inflation is becoming a massive problem for the government. Sure, Mervyn King may say that if you strip out X, Y and Z then underlying inflationary index is fine. But tell that to those paying £70 to fill up their car, or to those paying through the nose for food (see the graph below). They won’t buy it, and will then blame the government. Prosperity was the Teflon coating which protected New Labour. Conversely, inflation-induced misery will gnaw away at support for the coalition.

As David Laws argues in the Guardian today, a rate rise is painful. But not as painful as an emergency rate rise, which we’d need to inflict if we slip further down the inflationary spiral. My position on this is simple. If Mervyn King has decided that Britain needs to inflate its way out of a debt crisis, he should say so – and stop pretending to be surprised every month when inflation is way, way off his supposed target. (And yes, stop pretending that all that money the Bank printed during ‘Quantitative Easing’ was not going to affect the value of the money in our pockets). But regardless of what King thinks, he and his team are legally bound to hit a 2.0 percent CPI target. He should either do so, or make way for someone who can.

PS: Think 3.7 percent is bad? The following just in from Michael Saunders at Citi: “Our provisional forecast is for CPI inflation to hit 4.0 percent year on year in January, subsequently heading above 4.5 percent during 2011. It may even hit 5 percent year on year for a month or two.” He says King and the MPC face a “crisis of confidence” because of these overshoots.

Comments