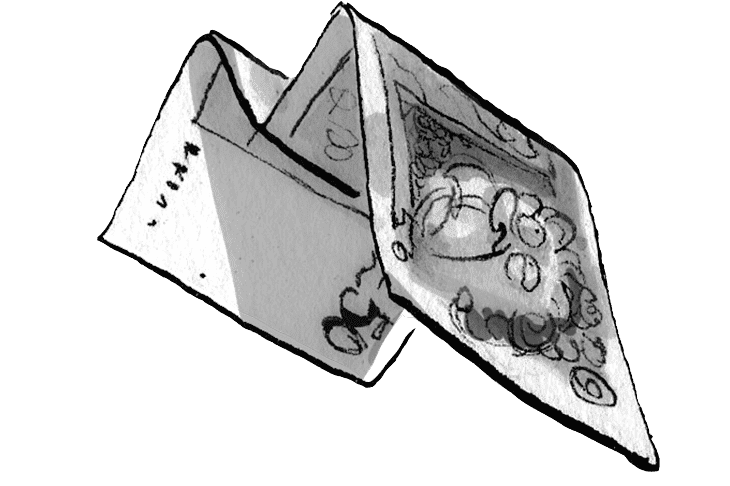

There is about to be a two-phase onslaught on the living standards of those on low-to-middling incomes.

On 1 October the energy price cap, for dual fuel, rises from £1,150 to £1,277. This is a rise of 11 per cent, at a time when furlough is ending and just a few days before the £1,000 a year uplift to Universal Credit is removed (which presumably Boris Johnson will not be swanking about in his big speech to Tory conference). That’s the first hit to living standards.

There’ll then be a gradual further erosion of living standards with rising food inflation (of around five per cent, as per what Tesco’s chairman John Allan said on my show this week).

The second big onslaught however comes in April, when the energy price cap is expected to be raised a further 17 per cent (!!!) to just under £1,500, based on the current wholesale price for gas.

The Prime Minister is hopeful we’ll be bailed out by rising wages

And that is precisely when Boris Johnson’s 1.25 percentage point rise in National Insurance kicks in, taking £12 billion a year from households and business.

I’m afraid that’s not the end of the squeeze on living standards.

The annualised increment to our energy bills from protecting the customers of just those few energy businesses that have collapsed in the past few days is a further £40. And that could rise by a further £50 if three more vulnerable medium size firms go down in the next week or so.

Ouch. Double ouch.

There is, however, a chance that the £90 increase in the network levy won’t fall on us in a single year – if the Treasury signs up to a rescue scheme that would see it establish an underwriting pot of around £2 billion.

This pot would be used to compensate companies taking on stranded customers of failed energy businesses, and would be recouped for the taxpayer over perhaps five years from smaller annual increments in the network levy (of say £18).

But even if that customer bailout charge is phased over a longer period, there is no escaping what will probably be the largest increase in the cost of living for around 25 years.

The Prime Minister is hopeful we’ll be bailed out by rising wages. But for us – and him – inflation-busting pay rises are a double-edged sword. Because they would turn one-off price increments into self-reinforcing inflation. And that would compel the Bank of England to raise interest rates.

The rising cost of money would bear down on housing wealth, depress consumer spending, depress investment, and increase the price for the government of funding £875 billion of its debt held by the Bank of England.

Quadruple ouch.

And if all that happens and Boris Johnson still feels secure in his job, the normal rules of politics really would have been suspended.

Comments