Rishi keeps coy on this week’s mini-Budget

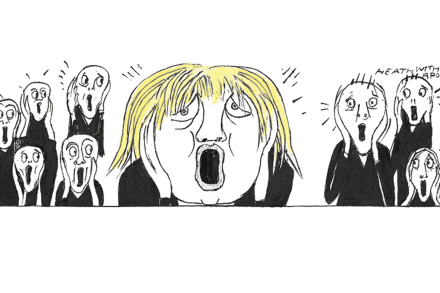

What support might the Chancellor dish out to help with the cost of living squeeze in the Spring Statement this week? In line with his previous media appearances, Rishi Sunak’s statements ahead of his mini-Budget this morning on the BBC didn’t give much away, as the Chancellor ‘can’t speculate’ on what’s to come in his announcements this week. But the pressure is on to address the energy and basic goods prices which have been skyrocketing since we emerged from the height of the Covid emergency: the energy price cap lifts nearly £700 this spring, and is likely to rise again in the autumn. Sunak reiterated that his job now is